For decades, globalization defined industrial success. Companies expanded manufacturing operations overseas to take advantage of lower labor costs, abundant resources, and international trade networks. Yet in recent years, a fundamental transformation has begun—one that redefines how and where products are made. This transformation is called onshore manufacturing, a growing movement that brings production back home, closer to the consumers and industries it serves.

Introduction — Why the World Is Turning Back Home

The global manufacturing landscape is changing fast. After years of outsourcing to distant regions, industries are now focusing on regional self-sufficiency. Events such as the COVID-19 pandemic, geopolitical conflicts, and global shipping disruptions have revealed just how fragile extended supply chains can be. Companies are learning that efficiency alone isn’t enough—resilience and proximity matter more than ever.

This shift toward onshore manufacturing and reshoring industry practices represents a structural change in global trade. Instead of relying on long, complex logistics networks, manufacturers are investing in local or national facilities that offer more control, faster delivery, and greater adaptability. The new industrial strategy combines technology, sustainability, and regional collaboration to create supply chains that can withstand global uncertainty.

The Global Supply Chain Under Pressure

Lessons from the Pandemic and Trade Wars

The early 2020s exposed critical weaknesses in the global supply system. When the pandemic hit, factory shutdowns across Asia and Europe left manufacturers worldwide scrambling for parts. Semiconductors, steel components, and raw materials suddenly became scarce, delaying production from automobiles to consumer electronics. Trade tensions between major economies further complicated logistics, adding tariffs and export controls that increased costs.

Governments responded with calls to bring production closer to home. The United States, Japan, and the European Union introduced financial incentives for domestic production of critical materials. The result was a renewed interest in onshore manufacturing—not as a temporary response, but as a strategic necessity for economic stability.

Rising Costs of Global Logistics

At the same time, shipping and logistics costs have soared. Between 2019 and 2022, freight rates for containers from Asia to Europe and North America multiplied several times over. Port congestion, fuel price increases, and the shortage of shipping containers caused historic delays. Companies that once depended on global efficiency now face an entirely new equation: higher transportation costs, longer lead times, and unpredictable delivery schedules.

To offset these challenges, businesses are evaluating the long-term benefits of local production. Advanced automation, robotics, and digital tools are helping close the labor cost gap between offshore and domestic manufacturing. Instead of chasing the cheapest production site, firms are prioritizing reliability, flexibility, and sustainability.

Understanding Onshore Manufacturing

What Is Onshore Manufacturing?

At its core, onshore manufacturing refers to the relocation or establishment of production facilities within a company’s home country. It contrasts with offshore manufacturing, where companies move operations abroad, and nearshoring, where production shifts to neighboring regions. The idea is to build resilience by reducing dependency on global supply lines.

This concept overlaps with the broader reshoring industry trend, which has gained momentum as nations rethink their industrial policies. Countries like the U.S., Germany, and South Korea are investing in domestic production capacity for sectors such as semiconductors, energy, steel, and pharmaceuticals. It’s not about rejecting globalization but redefining it through localized innovation.

Advantages of Onshore Manufacturing

The appeal of producing locally extends beyond economic nationalism—it’s a practical response to supply chain volatility. The key advantages include:

- Shorter supply chains: Reduced transportation distance leads to faster deliveries and lower emissions.

- Improved quality control: Easier oversight of production standards and process consistency.

- Regulatory compliance: Simplified coordination with domestic laws and standards.

- Economic growth: Strengthens local job markets and revitalizes industrial regions.

- Integration with automation: Digital technologies enhance competitiveness despite higher labor costs.

For many manufacturers, the decision to onshore is no longer a question of ideology—it’s a strategic investment in control and continuity.

The Role of Technology in the Reshoring Wave

Smart Factories and Automation

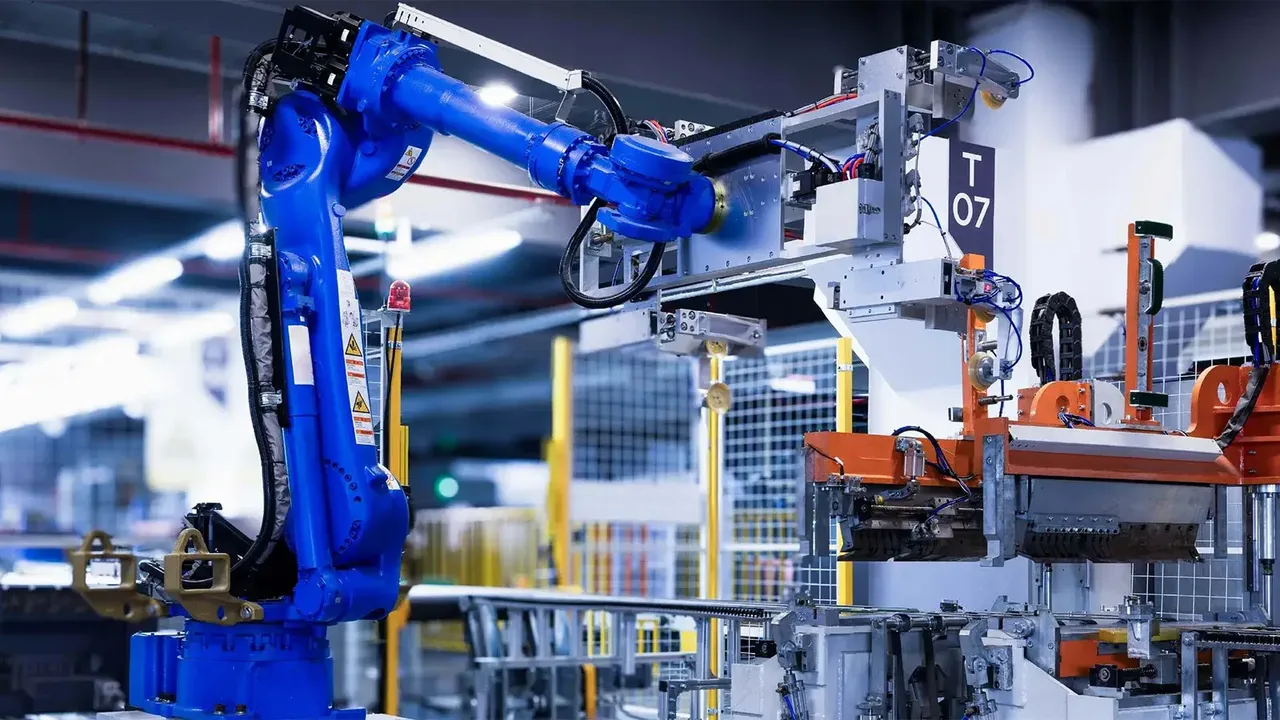

One of the biggest enablers of onshore manufacturing is automation. Smart factories powered by robotics, machine learning, and the Internet of Things (IoT) can produce goods with high precision and minimal human intervention. Automated systems reduce labor dependency and help offset the cost advantages once enjoyed by offshore production centers.

Advanced robotics are now commonplace in sectors like automotive, steel fabrication, and electronics. Factories can operate 24/7 with minimal downtime, using predictive maintenance systems to reduce failures. The emergence of “lights-out factories”—fully automated facilities that run in the dark because they don’t require human presence—illustrates how far technology has progressed.

Even energy efficiency is improving. Many automation systems rely on real-time monitoring to optimize energy use, reducing both cost and environmental impact. Insights from platforms like Energy.gov highlight how industrial automation can support sustainability while maintaining competitiveness.

Digital Supply Chain Management

Digitalization is another cornerstone of the reshoring movement. Artificial intelligence and predictive analytics allow companies to forecast demand more accurately and manage inventory efficiently. Blockchain systems, meanwhile, provide transparency and traceability—key factors in reducing fraud and ensuring ethical sourcing.

Through digital twins and cloud platforms, manufacturers can simulate production processes before physical rollout. This minimizes waste, streamlines design iterations, and enhances collaboration across teams. In essence, digital technology doesn’t just enable onshore manufacturing—it transforms it into a smarter, more adaptive ecosystem that rivals traditional global operations.

Economic and Strategic Impacts

For Governments

National governments play a critical role in accelerating the reshoring trend. Many have introduced tax incentives, grants, and public-private partnerships to attract investment in domestic industries. For example, the U.S. CHIPS and Science Act provides billions in subsidies for local semiconductor manufacturing, while Europe’s Industrial Strategy supports renewable and digital production initiatives.

Beyond economics, the move toward onshore manufacturing also strengthens national security by ensuring reliable access to critical resources. Energy, medicine, and food production are increasingly viewed as strategic assets rather than commodities, underscoring the geopolitical dimension of the reshoring wave.

For Businesses

From a corporate perspective, the rise of onshore manufacturing is not simply about patriotism—it’s a recalibration of global economics. Many firms are discovering that domestic production offers more stability and transparency, particularly in times of crisis. A cost-benefit analysis often reveals that although labor expenses may be higher at home, savings in logistics, lead time, and risk mitigation can balance the equation.

Companies that successfully reshored operations often share common strategies: they embraced automation, diversified suppliers, and reinvested in workforce training. These measures don’t just reduce dependency on offshore partners—they foster long-term resilience. Businesses are also able to respond faster to market trends, launch new products quickly, and maintain better quality control, all of which improve customer satisfaction and brand trust.

Challenges of Onshore Manufacturing

Higher Labor and Land Costs

Despite its advantages, onshore manufacturing is not without challenges. Labor and land costs in developed economies remain significantly higher than in low-cost manufacturing regions. Automation can bridge part of the gap, but it requires substantial upfront investment. For small and medium-sized enterprises (SMEs), these costs can be a major barrier to entry.

To address this, many countries are investing in training programs that enhance digital literacy and technical skills among workers. Skilled labor capable of operating advanced machinery and managing digital systems is essential to maintaining competitiveness. The future of manufacturing will depend as much on human expertise as on machines.

Supply Chain Reconfiguration Risks

Reshoring and supply chain redesign come with inherent risks. Building new domestic facilities means higher capital expenditure and longer lead times before full operational capacity is achieved. During this transition, companies may experience production slowdowns or temporary inefficiencies. Moreover, suppliers that once operated offshore must also adapt, either by relocating or establishing regional hubs.

Collaboration among industries, logistics partners, and policymakers will be key to smoothing this adjustment period. As supply chains evolve, businesses will need to focus on long-term strategy over short-term gains to ensure sustainable growth.

Sustainability and Local Production

Reducing Carbon Footprints

Beyond economics, onshore manufacturing aligns closely with environmental sustainability goals. Shorter supply chains mean fewer international shipments and reduced carbon emissions. Locally sourced materials and regional energy systems can dramatically lower a product’s environmental footprint. Many companies now measure their sustainability success not just by efficiency, but by how much transportation and resource waste they eliminate.

As part of the reshoring industry trend, domestic production also encourages better waste management and circular economy initiatives. Manufacturing waste can be recycled locally, and materials reused across industries, fostering a more self-sufficient ecosystem. Reduced shipping distances also make it easier to monitor environmental compliance and ethical labor practices.

Ethical and Environmental Benefits

When supply chains shorten, transparency improves. Consumers increasingly demand to know where their products come from, how they are made, and whether they adhere to fair labor and ecological standards. Local manufacturing allows for greater oversight, helping brands prove their commitment to sustainability ethics rather than relying on distant subcontractors with opaque practices.

Companies embracing onshore manufacturing are often rewarded with stronger reputations, community support, and long-term customer loyalty. By connecting production to purpose, these firms are shaping a more responsible industrial landscape.

The Future of Global Manufacturing

A Balanced Hybrid Model

Despite the momentum of reshoring, global trade will not disappear. Instead, the future likely points toward a hybrid system—one that combines global networks with localized production. This “glocal” model balances the efficiency of international collaboration with the security of regional independence.

Large corporations may continue to rely on offshore suppliers for certain raw materials but will increasingly produce and assemble final products close to their primary markets. This model not only improves responsiveness but also diversifies risk, reducing exposure to geopolitical disruptions.

Predictions for the Next Decade

By 2035, manufacturing hubs are expected to become more distributed, digitally integrated, and environmentally accountable. Countries investing in automation, renewable energy, and logistics infrastructure will lead this industrial transformation. The global logistics landscape will evolve toward flexibility—smaller, smarter distribution centers supported by data analytics and artificial intelligence.

Developing nations may also benefit by partnering in regional supply chains, offering specialized components rather than mass production. The key to success will be collaboration, transparency, and digital adaptation. In this interconnected world, independence and interdependence will coexist more strategically than ever before.

Conclusion — Building Resilient Industry at Home

The rise of onshore manufacturing marks a defining moment in the history of global industry. It represents not just a reaction to crises, but a proactive rethinking of how the world makes and moves goods. By embracing automation, digitalization, and sustainability, nations can build supply chains that are both resilient and responsible.

As economic power shifts from global efficiency to local stability, the companies that adapt fastest will lead the new industrial age. Reshoring industry strategies are not about isolation—they’re about balance. In the end, the future of manufacturing isn’t just about where things are made, but how thoughtfully, transparently, and sustainably they are produced.